|

|

|

|

|

Protectionism and Tariffs for kids: What are Tariffs?

Protectionism

Facts and History of

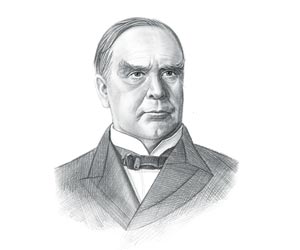

Protectionism for kids: Timeline of Tariffs and Events 1789: George Washington backed the first tariff in 1789 in order to raise revenue for the newly formed government and encourage the development of industries 1789: Alexander Hamilton, secretary of the treasury, introduced various economic polices was the principal advocate of import restrictions. Alexander Hamilton proposed high protective tariffs as part of his plans to clear the war debt incurred in the War if Independence. 1789: The Tariff Act of 1789, was the first major Act passed in the United States in which charges of up to 50% were imposed on selected goods, including “steel, ships, cordage, tobacco, salt, indigo and cloth 1816: The protective Tariff of 1816, placed a 20-25% tax on all foreign goods. Before the War of 1812, duties averaged about 12.5%. 1817: Henry Clay (1777 – 1852) devised the American System during the presidency of James Monroe during the Era of Good Feelings. The American System was an economic plan to boost the sales of US products and protect manufacturers from cheap British goods and was based on many of the ideas of Alexander Hamilton 1824: The Tariff of 1824 raised the duties still higher. There was 35% duty on imported iron, wool, cotton, and hemp and glass 1828: The protective Tariff of 1828 (the Tariff of Abominations) increased taxes to nearly 50% 1828: John C. Calhoun responded to the Tariff of Abominations with the South Carolina Exposition because the 1828 tariff favored the commercial interests of the North at the expense of the South. The controversy incited by the 1828 Tariff of Abominations led to the Nullification Crisis. 1832: The Nullification Crisis centered around the Southern protests against the protective tariffs (taxes) 1833: The Compromise Tariff, proposed by Henry Clay, was passed by Congress in March 1833 which would gradually lower the tariff rates over the next 10 years until, by 1842, they would be as low as they were by the Tariff Act of 1816. 1842: The Tariff of 1842, or Black Tariff, was a protectionist tariff schedule adopted during the John Tyler presidency to reverse the effects of the 1833 Compromise Tariff and tariffs were again raised again 1846: The Black Tariff of 1842 was repealed in 1846, when it was replaced by the Walker Tariff. The Walker Tariff was enacted by the Democrats under James Polk, and made substantially cut in the high rates of the "Black Tariff" 1857: The Walker Tariff remained in effect until the Tariff of 1857, which reduced rates further. 1861: The 1846 tariff rates initiated a 14 year period of relative free trade that lasted until the high Morrill Tariff of 1861 that raised tariff rates. The same year the Civil War broke out. 1866: Following the Civil War end saw the period of rapid growth in the economy due to the inventions and innovations of the Industrial Revolution. This period in American History gave rise to the wealthy businessmen and industrialists known as the Robber Barons, who firmly supported protectionist policies 1890: William McKinley was a Republican and an ardent Protectionist who believed in imposing tariffs to guard growing industries within the US from foreign competition. The McKinley Tariff became law on October 1, 1890 and was a protective tariff (tax) that raised the average duty on foreign imports to almost 50%. 1890: The McKinley Tariff, which became law on October 1, 1890, was a protective tariff (tax) that raised the average duty on foreign imports to almost 50%. The act was backed by the Republicans who strongly supported high tariffs on imported goods 1894: The McKinley Tariff was replaced with the Wilson-Gorman Tariff BY Grover Cleveland and the Democrat Party, which promptly lowered tariff rates again. 1897: The rates went up again when William McKinley became president and the 1897 Dingley Tariff was passed to counteract the effects of the Wilson-Gorman Tariff. 1909: The Payne-Aldrich Tariff was passed under President William Howard Taft reducing tariff rates but the Payne-Aldrich bill also enacted a huge income tax on the privilege of conducting business as a corporation 1922: The Fordney-McCumber Act was passed introducing the highest tariffs in American history enforcing the US Foreign Policy of Isolationism |

| US American History |

| 1881-1913: Maturation Era |

|

|

|

|

|

First Published2016-04-19 | |||

|

Updated 2018-01-01 |

Publisher

Siteseen Limited

| ||

|

|