|

|

|

|

|

At the same time the banking industry was unsettled with the rising success of trust companies and refused to help the trust companies. President Roosevelt was a "trust-buster". The American public started to fear that the banking and trust industries were both experiencing liquidity issues and had the cash to meet immediate and short-term obligations. This resulted in bank runs and triggered the nationwide financial panic of 1907 that lasted for months.

Panic of 1907 History for kids: The Conspiracy

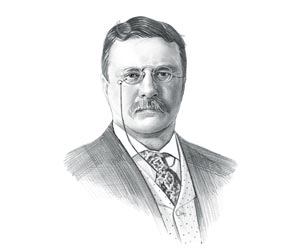

Panic of 1907 History for kids: President Roosevelt

Panic of 1907 History for kids: Banking Reform

Panic of 1907 Timeline 1890: The 1890 Sherman Antitrust Act attempted to clamp down on monopolies and protect against business practices that limited competition, or controlled prices. 1904: The 1904 Northern Securities Case was a victory for President Roosevelt in his "trust-busting" efforts when the Northern Securities Company, owned by banker J.P. Morgan and railroad magnate James J. Hill, was taken to court for violating the Sherman Antitrust Act 18 April 1906: The San Francisco Earthquake caused considerable monetary problems when many insurance companies went bankrupt and shares on the Stock Market began to fall June 29, 1906: The Hepburn Act which gave the Interstate Commerce Commission the power to set maximum railroad rates, resulted in the depreciation of the value of railroad securities July 1907: Copper prices collapsed and stock prices declined by 18% August 1907: President Roosevelt continued his "trust-busting" activities by levying a $29 million dollar fine against Standard Oil Corporation owned by John D. Rockefeller. Stock prices fell again. October 14, 1907: Copper magnates Augustus and Otto Heinze, attempted to corner the copper market. The plan backfired, bankrupting the Heinze Brothers. The Knickerbocker Trust, an American bank based in New York, was also involved in the attempted manipulation of the stock market October 21, 1907: The National Bank of Commerce announced that it would no longer accept checks for the Knickerbocker Trust Company. October 22, 1907: There was a run on the Knickerbocker Trust Company bank. October 23, 1907: Charles Barney, the president of the Knickerbocker Trust Company bank requested financial assistance from J.P. Morgan - the banker flatly refused to help. The Trust Company of America and Lincoln Trust Company also collapsed October 23, 1907: The Trust Company of America and Lincoln Trust Company also collapsed October 24, 1907: Banks started to collapse including the Twelfth Ward Bank, Empire City Savings, the Hamilton Bank of New York, First National Bank of Brooklyn, International Trust Company, Williamsburg Trust Company, Borough Bank of Brooklyn, Jenkins Trust Company and the Union Trust Company of Providence. October 24, 1907: New York banks stopped making the short-term loans that were used by stock traders and prices on the Wall Street Stock exchange began to crash. October 25, 1907: The panic continued to increase on Friday, October 25. J.P. Morgan attempted to get banks to make short term loans. Morgan made a statement to newspaper reporters: "If people will keep their money in the banks, everything will be all right..." October 28, 1907: On Monday October 28, the New York Clearing House issued $100 million in loan certificates to be traded between banks and confidence in the banks began to return Saturday, Nov 2: Moore & Schley, a major brokerage, nearly collapses because its loans were uncertainly backed by the Tennessee Coal, Iron & Railroad Company (TC&I) U.S. Steel makes a proposal to purchase TC&I. Mon, Nov 4, 1907: President Roosevelt approves U.S. Steel's takeover of TC&I, despite his trust-busting stance November 14, 1907: Charles Barney, the president of the Knickerbocker Trust Company bank was not financially ruined by the crash, but he was ostracized from the banking community and could not live with the disgrace. He shot himself in the abdomen with a .32 caliber revolver and died the same day. Aftermath: Following the Panic of 1907 and the Stock Market Crash the Postal Savings System was established and it was decided that America to have a central bank and the Federal Reserve was eventually created in 1913. |

| US American History |

| 1881-1913: Maturation Era |

|

|

|

|

|

First Published2016-04-19 | |||

|

Updated 2018-01-01 |

Publisher

Siteseen Limited

| ||

|

|